IFSC code is an 11-digit alphanumeric code used to recognize the bank branch of your account. The first 4 characters represent the ban, fifth one is zero and the last 6 numbers define the branch of the particular bank. IFSC code of particular banks such as IFSC ICICI Bank Mumbai is used while using online fund transfer facilities like NEFT, RTGS and IMPS. IFSC code is necessary during electronic fund transfer in order to avoid the risks or chances of errors.

Where can I get IFSC code?

You can get IFSC code of a bank, for example IFSC Code ICICI Thane in many different ways;

- You can get it from the cheque and passbook given by the bank

- Visit the website of the particular bank

- Search at the RBI website

- Look at reliable IFSC code checker tools online

There are many websites online that provide IFSC code checker tools and by using it you can get the right IFSC code of any branch of any bank, such as SBI IFSC Code Bangalore or SBI IFSC Code Bihar.

Features and importance of IFSC code

IFSC code is a must for identifying a bank’s branch. It helps make different online banking operations easy and hassle-free. You can do instant fund transfer, and error-free RTGS and NEFT transfer with immediate validation and confirmation to the users. Here we list out some important features of IFSC code.

- It facilitates easy branch location and identification

- It makes digitalization of bank transactions easy and error-free

- It enables immediate transfer of funds

- It encourages safety and saves time

- It promotes NEFT and RTGS

Various methods of online fund transfer using IFSC code

IFSC code is used to send funds online through 3 major quick payment systems in India and those are the following;

NEFT

National Electronic Fund Transfer is one of the electronic payment systems used for immediate interbank transfer of funds. In this method, the fund transfer time is performed within 2 hours. Major benefits of NEFT are – no limit on minimum and maximum amount to be transacted and is offered by all banks in India. Transfer is allowed between 8 AM-6.30 PM from Monday to Friday and 8 AM-1PM on working Saturdays. Charges for this transaction vary from bank to bank.

RTGS

It means Real Time Gross Settlement and is one of the fastest money transfers between banks in India. It transfers money within 1 hour and it has a minimum amount limit of 2 lakhs. You can avail the facility on RTGS enabled branches and the charge for transaction depends on the transaction amount.

IMPS

It means immediate payment system where money is sent to the beneficiary’s account within a few seconds. This is a secure method that makes use of 2-step verification process during transactions. It does not have any minimum amount limit for fund transfer but the maximum limit is different for banks.

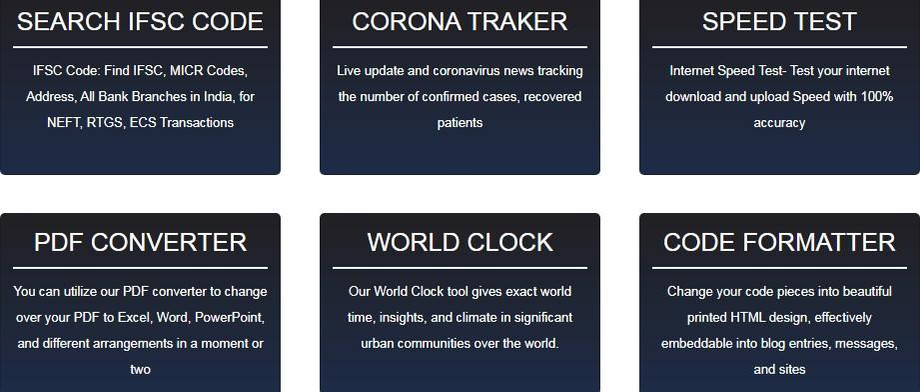

You can take advantage of IFSC code checker tools online that help you find codes of any branches, such as SBI IFSC Code Mumbai. You will find Html Formatter Online at these website for your advantage.